michigan gas tax rate

Michigan natural gas rates. 0242 per gallon.

Utah Sales Tax Small Business Guide Truic

Michigan Business Tax 2019 MBT Forms 2020 MBT Forms.

. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. The current federal motor fuel tax rates are. Below is a quick way to see how much more per week and year youd pay if gas taxes rose 45 cents a.

To enter the rates - go into the program and select Setup Configuration and. Unlike many states Michigan treats both candy and soda as groceries for sales tax purposes. 280 cents per gallon.

It would also set aside 300 million total for county road commissions cities and villages to account for projected lost revenue. Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline. GOP outraged as Whitmer rejects gas tax holiday Michigan income tax cut March 11.

Notice Concerning Inflation Adjusted Fuel Tax Act and Applicable to IFTA Motor Carriers That Will Take Effect on January 1 2022. Michigan gas taxes averaged 456 a gallon on Thursday according to AAA and state senators say a tax savings plan would save about 50 cents a gallon. Federal excise tax rates on various motor fuel products are as follows.

Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles. These taxes are included in the price of fuel purchased at the pump This memo provides background information on taxes imposed on motor fuels in Michigan. Michigan Gas Tax 17th highest gas tax.

Shutterstock LANSING Michigan senators reached a bipartisan agreement to press pause on gas taxes Thursday citing sky-high prices at the pump in recent weeks. How a rate review works. Diesel and Kerosene.

Michigan House lawmakers approved a Republican. Victorys bill SB 1029 would temporarily set Michigans per-gallon motor fuel tax rate at zero cents. MI Sales Tax Express Program Subject.

Prepaid GasolineDiesel Fuel Rates - July 2022 Effective July 1 2022 the State of Michigan has updated the prepaid gasoline and diesel fuel rates as follows. If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in Michigan sales tax. The Michigan sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MI state tax.

The increase is believed to be the result of higher inflation rates and sanctions related to Russias invasion of Ukraine. Natural gas prices as filed with the Michigan Public Service Commission. Michigan Gas Choice allows you to choose your natural gas supplier from participating suppliers.

The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. That ranks Michigan as the 10th highest tax per gallon of gas in the nation. Most jet fuel that is used in commercial transportation is 044gallon.

How does the Michigan gas tax work. Notice of Prepaid Sales Tax Rates on Fuel in Effect for the Month of July 2022. 1 2017 as a result of the 2015 legislation.

This tax is established in the Motor Fuel Tax Act 2000 PA 403. Use the Michigan Gas Tax Calculator by the Michigan Petroleum Association to caluclate the fuel taxes you pay. Federal motor fuel taxes.

That includes a roughly 1. Nationwide the price of regular gasoline on average hit. Michigan fuel taxes last increased on Jan.

In Michigan were paying some of the highest taxes per gallon in the nation and todays rate is because of a tax signed into law in 2015. Taken together this amounts to 49. The same three taxes are included in the retail price on.

Effective August 1 2022 through August 31 2022 the new prepaid sales tax rate for. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. Gas and Diesel Tax rates are rate local sales tax varies by county and city charged in PPG Other Taxes include a 075 cpg UST gasoline and diesel Hawaii.

Mar 25 2020. Michigan Business Tax 2019 MBT Forms. Was 3102 cents while the federal gas tax rate was 184 cents.

Michigan House GOP plans to replace sales tax on gasoline to fund roads. Fuel producers and vendors in Michigan have to pay fuel excise taxes and are responsible for filing various fuel tax reports to the Michigan government. So far in 2021 inflation has been unusually high.

Michigan Fuel Tax Reports. The proposal is split into four bills that would enact tax suspensions from June 15 through Sept. Didnt gas taxes just go up.

Notice to Motor Fuel Statutory Refund Claimants. Whitmer signals likely veto on Michigan gas tax holiday LANSINGAs gasoline prices hit record highs nationwide Michigan leaders are pushing for gasoline tax relief but differ on how the state should offer it. Diesel is 313 cents per gallon.

1 2020 and Sept. The tax on regular. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the states 2022 fiscal year.

The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. The Michigan gas tax is included in the pump price at all gas stations in Michigan. Information on natural gas service and rates for residential customers in Michigan.

But that was based. If passed Whitmers gas tax would bring Michigans rate to 713 cents a gallon the highest in the nation. 235 cents per gallon Prepaid Diesel Fuel Rate.

Michigans excise tax on gasoline is ranked 17 out of the 50 states. When the gas tax increase kicks in just months from now Michigan residents will find themselves paying as much as 14 cents more per gallon. And the states gas tax as a share of the total.

Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

Gasoline is 273 cents per gallon. Other items including gasoline alcohol and cigarettes are subject to various Michigan excise taxes in addition to the sales tax. Ever wondered how much of your Gas purchase at the pump goes to Taxes.

0184 per gallon. This would bring your total gas tax bill to 617 cents per gallon. As of January 2022 the average state gas tax in the US.

Pennsylvania is now the highest at 576 cents per gallon.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

States With Highest And Lowest Sales Tax Rates

Michigan S Gas Tax How Much Is On A Gallon Of Gas

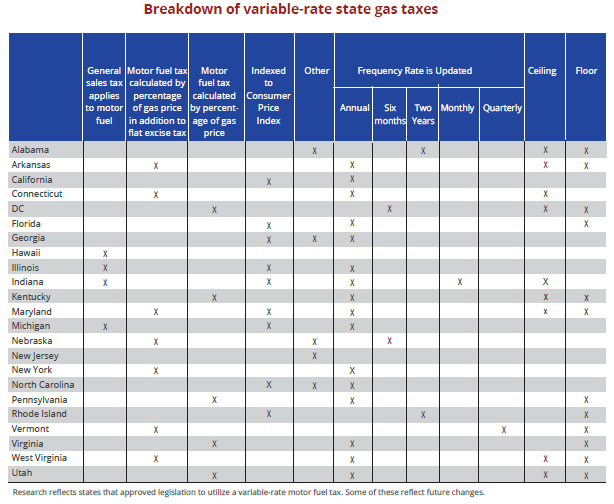

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

State Corporate Income Tax Rates And Brackets Tax Foundation

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Most Americans Live In States With Variable Rate Gas Taxes Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

U S States With The Highest Gas Tax 2022 Statista

U S States With The Highest Gas Tax 2022 Statista

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Motor Fuel Taxes Urban Institute

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact